jefferson parish property tax 2020

Search our database of Jefferson Parish County Property Auctions for free. Its Fast Easy.

Properties that are subject to sale are published.

. JEFFERSON LA The Jefferson Parish Adjudicated real estate auction scheduled for August. Jefferson Parish Assessors Office - Property Search. A variety of property tax exemptions are available in jefferson parish county and these may be deducted from the assessed value to give the propertys taxable value.

The total number of parcels both commercial and residential is 185245. The Judicial Sales Office hours are 800 am to 430 pm Monday through Friday. Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website.

In order to redeem the former owner must pay Jefferson Parish 12 per annum 5 on the amount the winning bidder paid to purchase the property at the Jefferson Parish Tax Deeds. Find and bid on Residential Real Estate in Jefferson Parish County LA. Its Fast Easy.

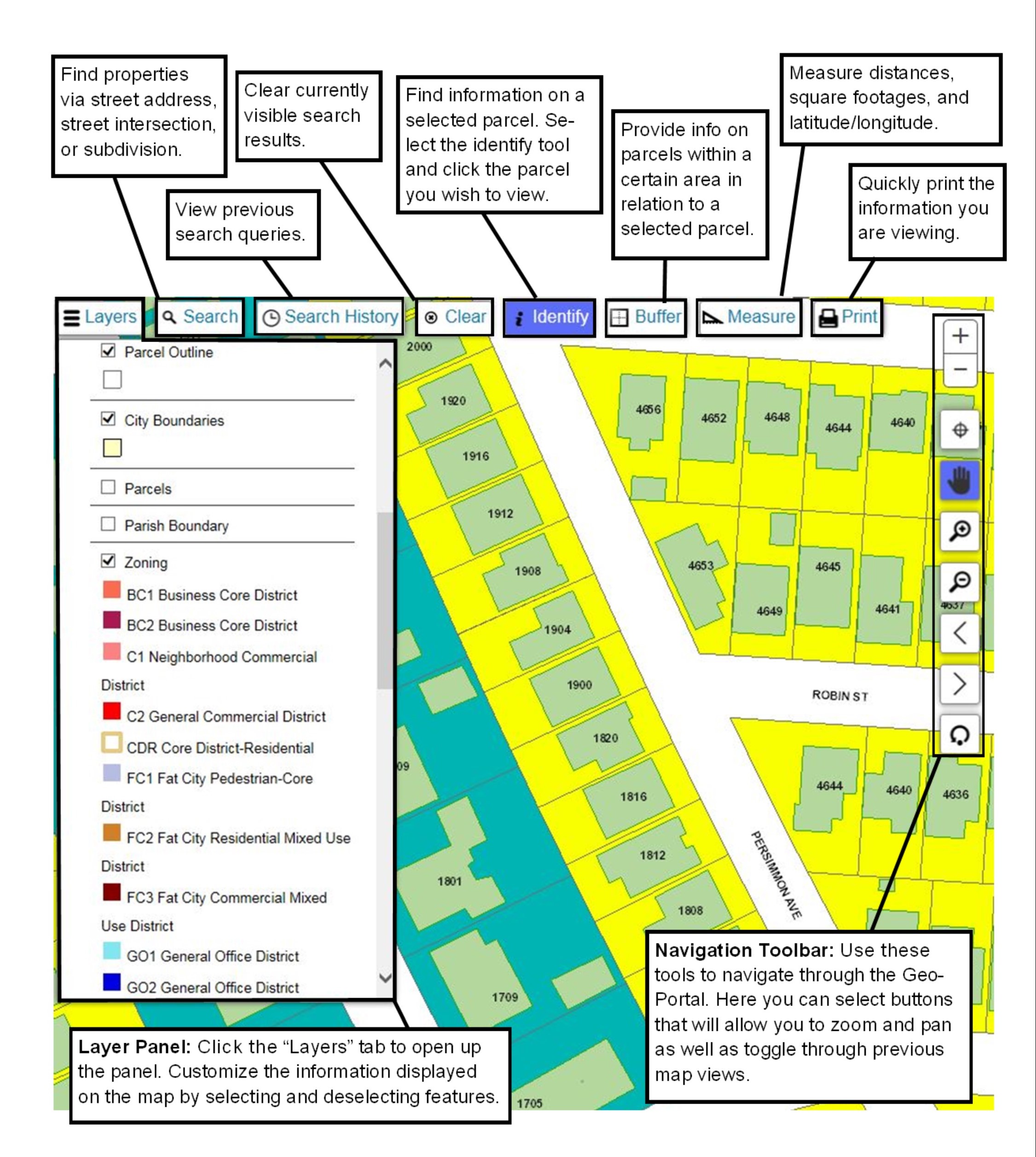

You may phone us at 504-363-5600. 2020 property tax notices to Jefferson Parish residents and businesses by Monday December 7 2020. Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website.

Utilize our e-services to. Adjudicated Property Auction to be Held Online on August 15 August 19 2020. The total assessed value of all property in the parish which also includes utilities and certain commercial fixtures and equipment was 396 billion up about 3 from 383.

LEBLANC AND DONNA S. 812 HELIOS AVENUE METAIRIE LA. It is expected to generate approximately 93 million dollars per year.

Jefferson Parish Sheriffs Office. You may call or visit at one of our locations listed below. Jefferson Parish collects on average 043 of a propertys.

Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes View Pay Water Bill BAA Fine. If approved the millage will be collected for a period of 10 years beginning in 2025. Find directions to Jefferson Parish County browse local businesses landmarks get current traffic estimates road conditions and more.

Download a Full Property Report with Tax Assessment Values More. Ad View County Assessor Records Online to Find the Property Taxes on Any Address. Property Maintenance Zoning Quality of Life.

Ad View County Assessor Records Online to Find the Property Taxes on Any Address. Jefferson Parish Assessors Office - Property Search. The assessors office has not released a parish-wide assessment for this year but they plan on.

Download a Full Property Report with Tax Assessment Values More. Almost half the money raised goes to. Jefferson Parish collects on average 043 of a.

WHITNEY BANK VS AVENUE WINES INC GLENN T. Only open from December 1 2021 - January 31 2022. A spokesperson with the Jefferson Parish school board made no comment.

If you are seeking certification of taxes paid for the purposes of an act of sale re-financing or to comply with other legal requirements please click the Tax Research Certificate button below to. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. 20 rows Jefferson Parish Wards.

2021 Plantation Estates Fee 50000. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. Our office is open for business from 830 am.

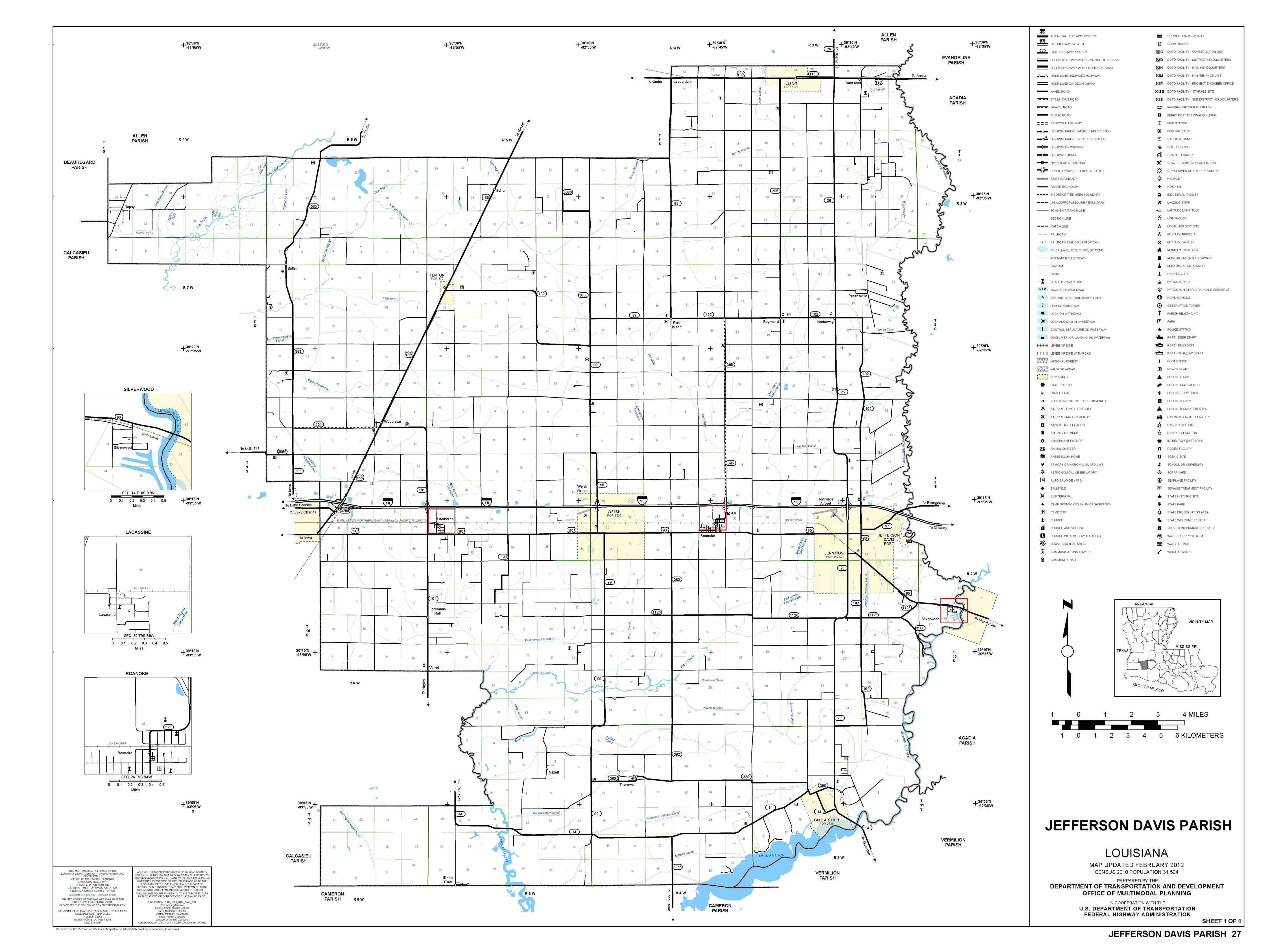

Jefferson Parish County la. Learn all about Jefferson Davis Parish re.

Tax Division Jefferson Davis Parish Sheriff S Office

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

Jefferson Parish Sheriff Joseph Lopinto Will Seek Property Tax Increase For Employee Pay Raises Crime Police Nola Com

Home Page Morehouse Parish Assessor S Office

Tax Increase For Jefferson Parish Sheriff S Office Would Fuel 20 Pay Raises Sheriff Says Crime Police Nola Com

Nj Property Taxes Climbed 2020 Average 9 000 Overview Of Hopatcong Lake Region

Few Increases For 2019 Jefferson Parish Property Tax Rates So Far News Nola Com

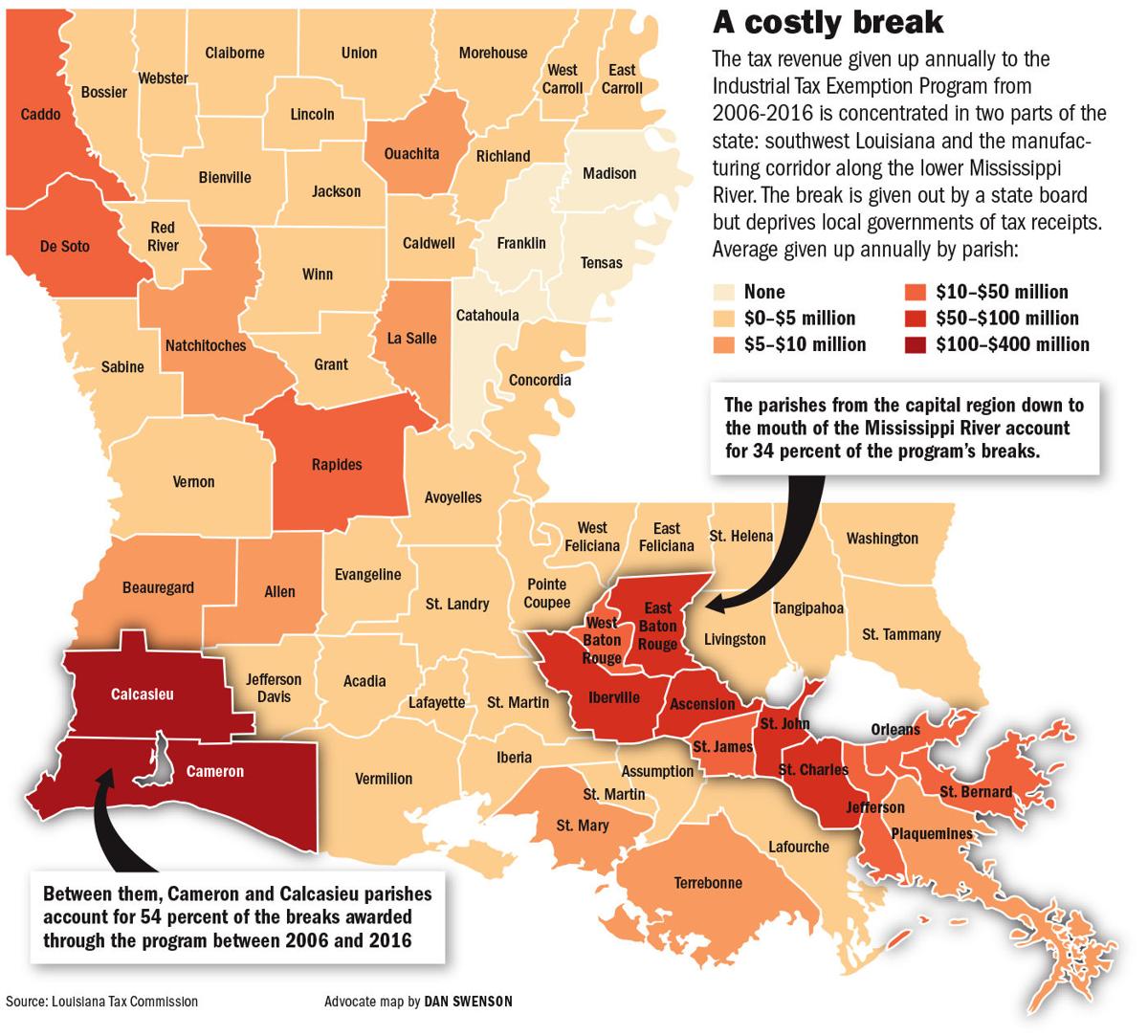

Why Louisiana Isn T The Petrochemical Silicon Valley Of The United States Via Nola Vie